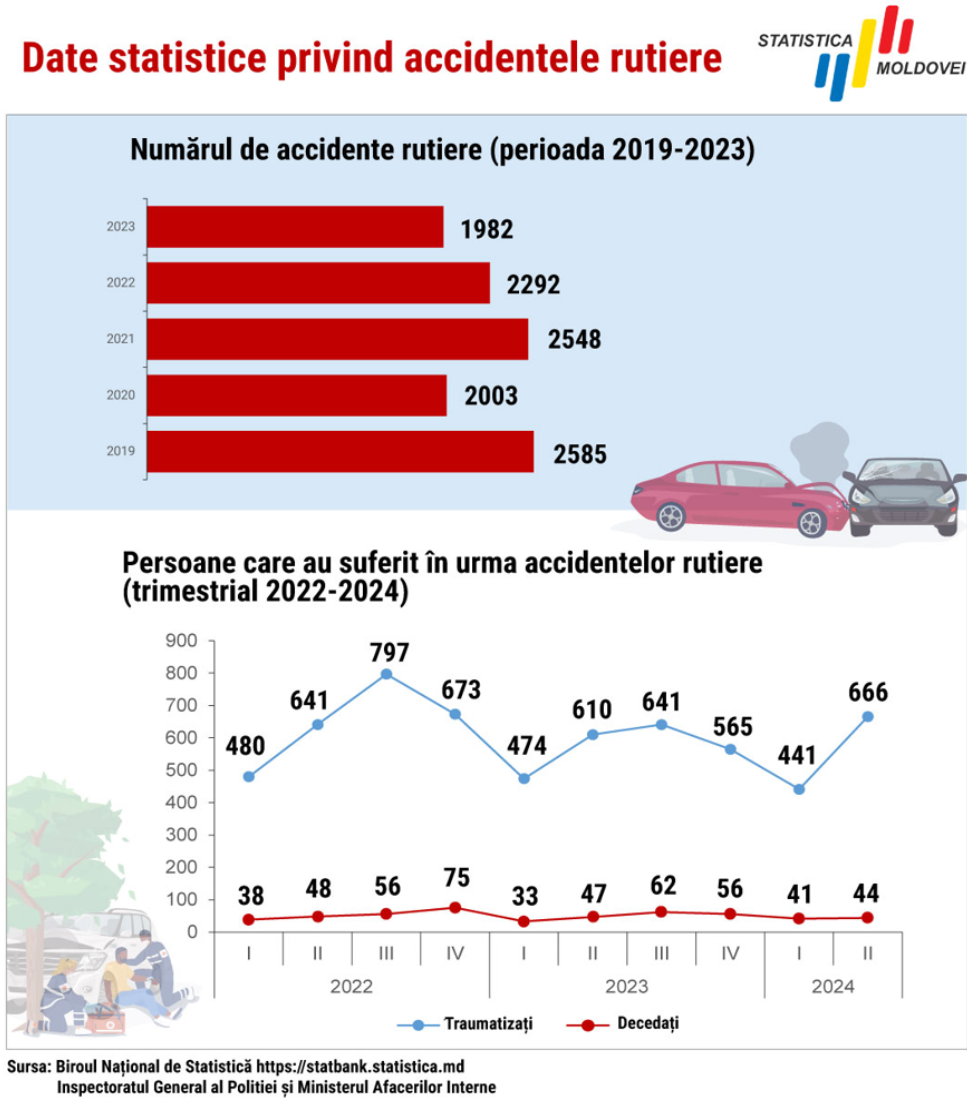

The number of road accidents has decreased in Moldova in recent years, but the risks on the roads remain significant.

In the Republic of Moldova, drivers face the dilemma of understanding the benefits of MTPL (Compulsory motor third-party liability insurance) and Comprehensive Car Insurance. Although the number of traffic accidents slightly declined – 1,982 accidents in 2023 compared to 2,292 in 2022 – the financial impact of such events remains high. A single serious collision can result in damages amounting to hundreds of thousands of lei, a sum that most drivers cannot afford. Understanding the differences between MTPL and Comprehensive Car Insurance is essential for financial protection and smart budgeting, especially amid recent changes in Moldova’s auto insurance market (such as tariff liberalization, rising costs, etc.). The following comparative guide provides clear information on each type of policy, their advantages and limitations, and practical recommendations for both individual drivers and companies with vehicle fleets that want to make an informed decision.

What does MTPL cover, and what does Comprehensive Car Insurance cover?

MTPL (Compulsory motor third-party liability insurance) is mandatory by law for all vehicles operating on public roads in Moldova. MTPL covers damages caused to third parties in the event of an accident caused by the policyholder. In other words, if a driver causes an accident, MTPL compensates the victims (both bodily injuries and material damage to other vehicles or property) within certain coverage limits.

In Moldova, the MTPL liability limit is €100,000 for material damage per accident (regardless of the number of affected parties) and €100,000 per injured person or €500,000 in total per accident for bodily injuries and deaths – converted into lei at the official exchange rate.

MTPL does not cover damages to the at-fault driver’s own car or their injuries—these remain their own responsibility. Since it is regulated by law, all vehicle owners must hold a valid MTPL policy. Driving without it leads to severe penalties (fines from 1,500 to 3,000 lei, penalty points, and even vehicle seizure).

Comprehensive Car Insurance is a voluntary insurance policy taken at the owner’s discretion. While not legally required, it may become mandatory under certain contractual conditions – for example, when the vehicle is purchased through leasing or credit, the lender usually demands Comprehensive Car Insurance coverage for the loan duration.

Comprehensive Car Insurance covers damage to the insured vehicle in various situations: from traffic accidents (regardless of fault), to theft, vandalism, fire, or natural disasters. Comprehensive Car Insurance offers complete protection for the insured car, regardless of who caused the damage. If you have Comprehensive Car Insurance and are involved in an accident (even your own fault), your insurer will pay for the repair of your vehicle – a crucial benefit absent from MTPL.

In addition, Comprehensive Car Insurance typically covers a wider range of risks: collisions, rollovers, falling objects, fire, explosion, vandalism, and natural phenomena such as lightning, floods, hail, landslides, etc.

For a complete overview, visit the dedicated MTPL and comprehensive car insurance pages and learn how they can protect you in the event of a road accident.

Advantages and limitations of MTPL

Advantages of MTPL:

- Mandatory and universal. The main benefit of MTPL is that it is required by law – all drivers must have it, meaning in theory, any road accident victim will be compensated by the at-fault party’s insurer. This system protects both the injured third parties (who might not otherwise be compensated) and the at-fault driver, who would otherwise have to pay out of pocket for the damages they caused. MTPL takes on the financial risk and ensures compensation is paid, within legal limits, so neither the victims nor the at-fault party bear the full cost.

- Relatively low cost. Compared to Comprehensive Car Insurance, MTPL premiums are much more affordable. As a standardized and regulated product, the MTPL price for a personal-use vehicle typically ranges from a few hundred lei per year, depending on factors like the driver’s age, experience, claims history, and vehicle characteristics (engine capacity, power, etc.).

- Broad civil liability coverage. MTPL covers both material damage and bodily injury caused to third parties, including passengers in the insured vehicle or others (excluding the at-fault driver). This provides a legal safety net – accident victims receive compensation without needing to sue the responsible party, simplifying the claims process.

Limitations of MTPL:

- Does not cover own vehicle damage. MTPL’s major drawback is that it does not pay for repairs to the at-fault driver’s own vehicle. If you cause an accident, your MTPL will only cover damage to others. Your own losses are your responsibility. For example, if you hit a pole or drive into a ditch, MTPL will not cover your repair costs – you bear the full expense.

- Risk of non-coverage if the at-fault party has no MTPL. Ideally, every driver has valid MTPL coverage, but in reality, some drive uninsured. If you’re hit by an uninsured driver, you must claim compensation from the National Bureau of Motor Insurers (BNAA). Moldova has a protection fund administered by BNAA for these cases.

- Limited to civil liability with exclusions. MTPL covers only damage caused to others in a typical road accident. Many situations fall outside its scope. For instance, natural disasters (floods, storms, hail, earthquakes, etc.) are explicitly excluded. Damage from vandalism or theft is not covered, nor are the medical expenses of the at-fault driver, legal costs, or indirect financial losses. In short, MTPL is strictly third-party liability insurance with narrow coverage.

Advantages and limitations of Comprehensive Car Insurance

Advantages of Comprehensive Car Insurance:

- Full protection for your own vehicle. Comprehensive Car Insurance’s main benefit is that it covers virtually any damage to your insured vehicle, no matter the cause (as long as the risk is included in the policy). Unlike MTPL, a good Comprehensive Car Insurance policy pays for your vehicle’s repair even if you were at fault. This coverage is crucial in cases like: losing control and damaging your car, vandalism, theft, or destruction due to fire, lightning, flooding, etc.

- Wide range of covered risks. Comprehensive Car Insurance is a comprehensive insurance that can include various risks depending on the package. Typically, it covers both road-related and unrelated incidents. Standard Comprehensive Car Insurance risks include: vehicle collisions, overturning, vandalism, theft, fire, explosion, and natural disasters (lightning, hail, flooding, landslides, etc.).

- Flexibility and extra benefits. Comprehensive Car Insurance policies are usually customizable. Drivers can select the insured sum, deductibles (the part of a claim paid by the policyholder), and extras like roadside assistance, replacement car during repairs, or coverage for personal belongings inside the vehicle.

Limitations of Comprehensive Car Insurance:

- High cost. The main downside is the significantly higher price compared to MTPL. Because it covers more risks and your own damages, Comprehensive Car Insurance annual premiums for a standard car can range from several thousand lei, depending on the car’s value and the driver’s profile. Often, premiums range from 3% to 10% of the vehicle’s value annually.

- Deductibles and specific conditions. To lower the Comprehensive Car Insurance premium, insured drivers sometimes choose deductibles – agreeing to pay part of each claim out of pocket. This reduces the premium but means minor claims won’t be fully reimbursed. (e.g., with a €100 deductible and a €500 claim, the insurer pays only €400). Comprehensive Car Insurance also comes with specific requirements: an anti-theft system, notifying police in certain cases (theft, vandalism, major accidents), and maintaining the vehicle in good technical condition. Ignoring these can void your coverage.

- Limited availability for old or high-risk vehicles. Insurers may decline or restrict Comprehensive Car Insurance coverage for very old cars (e.g., over 10–15 years) or high-risk models (e.g., powerful sports cars or right-hand-drive vehicles). Even if offered, Comprehensive Car Insurance premiums rise substantially for high-risk vehicles, such as collector or luxury cars.

How much does MTPL and Comprehensive Car Insurance cost in Moldova?

The prices of MTPL and Comprehensive Car Insurance insurance in Moldova vary depending on several factors.

For MTPL, the main elements influencing the cost are:

For Comprehensive Car Insurance, the price depends on:

Thus, to get the best cost-benefit ratio, it is recommended to compare offers from multiple insurers and choose the policy that suits your needs.

For MTPL, the main elements influencing the cost are:

- The age and driving experience of the driver;

- The driver’s claims history (bonus-malus system);

- Vehicle characteristics (engine capacity, type of vehicle);

- The vehicle’s use (personal or commercial).

For Comprehensive Car Insurance, the price depends on:

- The vehicle’s value;

- The make, model, and age of the vehicle;

- The selected coverage and included risks;

- The applied deductibles (the part of the damage paid by the insured);

- The driver’s claims history and experience;

- The area of use and parking conditions.

Thus, to get the best cost-benefit ratio, it is recommended to compare offers from multiple insurers and choose the policy that suits your needs.

Practical recommendations for drivers – how to save without excessive risk

Choosing between only MTPL or adding Comprehensive Car Insurance protection depends on each driver’s needs, the type of vehicle owned, and available budget. Here are a few practical recommendations for finding an optimal balance between savings and security:

1. New or relatively new cars of high value – they deserve protection, particularly as they are more likely to be targeted for theft;

2. Cars bought through leasing/credit – often Comprehensive Car Insurance is mandatory, but even if it’s not, it makes sense to protect something you’re still paying for;

3. Drivers who depend on their vehicle (if being without a car would severely impact your daily or professional life) – Comprehensive Car Insurance ensures quick repair funds or a temporary replacement;

4. High-risk areas – if you live in an area with frequent thefts, vandalism, or natural disasters (floods, falling trees during storms), Comprehensive Car Insurance provides vital protection.

On the other hand, if you own an old car with very low market value, the annual Comprehensive Car Insurance cost might not be justified (you could pay more in premiums over a few years than the car is worth). In such cases, many owners choose to save money into a personal emergency fund for repairs.

The key is to weigh the risks: a €2,000 car might not deserve a €300/year policy, but a €20,000 vehicle definitely does.

- Never drive without MTPL! It is a legal obligation. First, the fines and penalties for lacking MTPL far exceed the policy cost, making it financially inefficient and risky to skip this mandatory insurance. Second, without MTPL you expose yourself to devastating financial damages – a moment of distraction can cause damage worth tens or hundreds of thousands of lei to others, for which you would be directly liable. So, your first priority is to always have valid MTPL, renewed on time.

- Evaluate realistically whether you need a Comprehensive Car Insurance policy. Ask yourself: “If tomorrow my car were stolen or completely destroyed, could I afford the loss?” If the answer is no, or if the vehicle is a major asset for you (as an investment or for daily use), then Comprehensive Car Insurance should seriously be considered. As a general rule, Comprehensive Car Insurance is especially recommended in the following situations:

1. New or relatively new cars of high value – they deserve protection, particularly as they are more likely to be targeted for theft;

2. Cars bought through leasing/credit – often Comprehensive Car Insurance is mandatory, but even if it’s not, it makes sense to protect something you’re still paying for;

3. Drivers who depend on their vehicle (if being without a car would severely impact your daily or professional life) – Comprehensive Car Insurance ensures quick repair funds or a temporary replacement;

4. High-risk areas – if you live in an area with frequent thefts, vandalism, or natural disasters (floods, falling trees during storms), Comprehensive Car Insurance provides vital protection.

On the other hand, if you own an old car with very low market value, the annual Comprehensive Car Insurance cost might not be justified (you could pay more in premiums over a few years than the car is worth). In such cases, many owners choose to save money into a personal emergency fund for repairs.

The key is to weigh the risks: a €2,000 car might not deserve a €300/year policy, but a €20,000 vehicle definitely does.

- Choose your Comprehensive Car Insurance coverage wisely to save money. Deciding to purchase Comprehensive Car Insurance doesn’t mean you must go for the most expensive “full-option” package. Insurers usually offer flexible Comprehensive Car Insurance options. Think about your biggest concerns – theft? severe accidents? weather extremes? – and tailor the policy accordingly. Also ask your insurer about available discounts: paying annually instead of in installments, insuring another item (e.g., home) with the same company, bonuses for anti-theft systems, etc. Another tip: don’t buy redundant insurance. For example, if you already have Comprehensive Car Insurance, you likely don’t need a separate theft policy – check what Comprehensive Car Insurance already includes.

- Maintain a clean history and stay informed. For both MTPL and Comprehensive Car Insurance, a claim-free history helps you pay less in the future. Drive safely, and consider covering minor damage out of pocket (e.g., a 200-lei scratch might not be worth claiming if it means losing your no-claim discount and paying more next year). Also, stay informed annually about the market: reference MTPL tariffs may change, new Comprehensive Car Insurance offers may appear, and new players might enter the market. Follow official announcements (BNM, CNPF) and insurance news outlets.

UNAM partners in the field of motor insurance

Within the Union of Insurers of Moldova (UNAM), there are member companies that provide both MTPL insurance and voluntary Comprehensive Car Insurance. These products are essential for drivers in the Republic of Moldova, since MTPL protects third parties affected in the event of a road accident, while Comprehensive Car Insurance covers damages to the policyholder’s own vehicle in unforeseen situations such as accidents, theft, vandalism, or natural disasters. Through these policies, drivers and companies with car fleets benefit from financial security and compliance with the legal framework, having access to complete protection tailored to their needs.

UNAM member companies offering MTPL and Comprehensive Car Insurance products:

UNAM member companies offering MTPL and Comprehensive Car Insurance products:

Conclusion

MTPL or Comprehensive Car Insurance? In reality, it’s not about choosing one over the other, but about identifying the right combination for your situation. MTPL is mandatory and irreplaceable – insurance you cannot drive without, protecting you from financial liability toward others. Comprehensive Car Insurance, while optional, is extremely valuable for protecting your own asset and investment in the vehicle. If you own a modest car that you can afford to repair or replace from your savings, MTPL alone might suffice (possibly complemented by cautious driving and a personal emergency fund). However, if you own a valuable vehicle or simply don’t want to take on the risk of unexpected major expenses, Comprehensive Car Insurance becomes a smart choice, offering a good cost-benefit ratio especially considering today’s high repair and parts costs. Many drivers in Moldova adopt a combined approach: they purchase MTPL and, based on their needs, choose a Comprehensive Car Insurance policy – whether full or partial – so they can sleep peacefully knowing their vehicle is protected.

In summary, drivers should be both careful on the road and cautious in managing financial risks.

In summary, drivers should be both careful on the road and cautious in managing financial risks.